Love makes a family, the saying goes, but -- as LGBT parents quickly discover -- love isn't enough: money plays a central role as well. From family creation to securing legal ties and finding welcoming schools, parents and prospective parents may face additional, unique financial obstacles because they are LGBT.

It's not all dollar signs either. Costs may also come in terms of time and other trade-offs. Lack of family support and an unfriendly political climate can add to the challenges. Balancing financial, emotional, and time-management needs can require a combination of frugality, creativity, and luck.

Getting Pregnant

Infertility can be costly for anyone, but it can hit queer families particularly hard. Most insurance companies will not pay for fertility treatments until after a certain number of failed attempts to have a child without it. For different-sex, cisgender couples, that simply means having unprotected vaginal intercourse.

For individuals or couples who only have uteruses, however, this means inseminating at a medical clinic, explained Liz Coolidge, a family and parenting services coordinator at Fenway Health in Boston. Costs vary depending on the clinic, but Fenway charges an initial fee of $300 plus $250 for each standard insemination. Unless the person or couple is using donated sperm, they must also buy a sample at an additional $400 to $1,000 per vial, plus $200 for the cryogenic shipping.

Even with an infertility diagnosis, infertility coverage is only mandated in 15 states, and the specifics of what (and who) is covered vary, according to Resolve, the National Infertility Association. In 2016, four lesbians filed a federal civil rights lawsuit against the state of New Jersey over a mandate that women demonstrate infertility through "two years of unprotected sexual intercourse" before treatments are covered. In response, Gov. Chris Christie signed a law this spring that requires infertility treatments be covered for parents of any sexual orientation.

Two New York bills are pending that would mandate infertility coverage "regardless of [the] sexual orientation, marital status, or gender identity" of the insured. Hawaii has a similar bill. Since 2013, California has required equal coverage for LGBT prospective parents; while Maryland requires insurers provide married same-sex couples the same benefits provided their heterosexual counterparts.

The costs of infertility can quickly add up. "We definitely live paycheck to paycheck," said Nicole, a high school English teacher. She and her wife, Bethany, a child development specialist, live in San Diego with their 1-year-old son, who they had after a long battle with infertility. They own a home, but have no savings.

The couple first tried to get Nicole pregnant at a clinic through intrauterine insemination, which has a better success rate than intracervical inseminations (the "turkey baster" method typically done at home with a syringe). After multiple failed attempts at $2,000 a pop, they discovered Nicole's fallopian tubes were blocked. They switched to in vitro fertilization, where the eggs are taken out and fertilized in the lab before being placed in the uterus. Their plan was to use Nicole's eggs and have Bethany carry them. The cost of IVF in San Diego was over $17,000 per attempt. Their insurance only covered medication. The couple took out a loan and got creative: they rented a house in Colorado Springs, where a clinic offered the same procedure for $10,000. Bethany got pregnant on the first try.

They'd like to have another child, but, "financially, right now, we can't afford to," Bethany said. Nicole and Bethany have also been unable to afford the legal protections of a second-parent adoption and a termination-of-rights document from the donor, which they said would cost about $3,000. Instead they drew up their own document for the donor, based on online examples. Both of their names are on their son's birth certificate, but -- after the election -- they've started worrying they need the added strength of a legal adoption.

"At some point we were literally broke," said Katrina, who faced infertility issues with her wife Tiffany. The couple, who produce the video blog Two Mommies and a Blessing, live in upstate New York where Katrina works part-time as a counselor and Tiffany is a police detective.

When Tiffany and Katrina started their journey to parenthood in 2007, Katrina said, "Tiffany was barely making $900 a month, our rent was $600, and we had one car that always had issues." Katrina was unemployed, unable to keep a job while taking off so much time to see specialists.

The couple initially chose IUI because it was what their insurance covered. They elected an open donor (one who allows contact once the child turns 18) "because it was cheaper." Tiffany's insurance paid for 75 percent of the procedure, but not the sperm or medications. They tried four times without success, paying about $7,000 in total.

They took a year off, then tried again with a new clinic and new donor. In the meantime, Katrina had been diagnosed with only one working fallopian tube, and their insurance now covered IVF and most of the medications. "That was a huge relief," Katrina said. They had also managed to save the $2,300 out of pocket for sperm, medications, and co-payments.

Still, "money was always a worry," Katrina admitted, but added, "We desperately wanted to have a child of our own, so we would have sacrificed even more if we did not get pregnant." Luckily, they did, and their son is now 7.

New Yorkers Chelsea and Chris, who publish the video blog LBC Party of Five, bore the cost of infertility treatments while raising two special-needs children, who Chelsea had from a previous marriage. Chris works in law enforcement and Chelsea is a paralegal. Chelsea conceived her first two children easily, but tried unsuccessfully for two years to have a third, with four rounds of IUI costing about $5,500. Chelsea also went through two surgeries for endometriosis, a condition of the uterus lining that can contribute to infertility.

Chelsea and Chris went to a different clinic and were advised to try IVF, "which scared us solely because of the costs involved," Chris said. They took out a personal loan to buy supplemental insurance, which covered two IVF cycles, but not the medicines

or sperm, which added $5,600. Still, they managed to get pregnant.

After they had their third child, Chris came out as transgender, which had financial implications for them as well. He explained, "I opted for a more expensive insurance plan to ensure that hormone replacement therapy and any related surgery would be at a minimal out-of-pocket cost."

Sometimes, misinformation about LGBT people can also add costs. Tom*, a transgender man who works in digital publishing in New York, recalled trying to conceive with his then-partner, a cisgender woman. They tried multiple times with sperm banks and a nurse friend helping them do IUI at home.

"Late in the game" they discovered their insurance would cover pre-conception testing, even though they were queer. Through testing they learned Tom's partner, "the one into whom most of the expensive bank sperm went," was "100-percent infertile." Tom ultimately got pregnant with their fourth donor. The couple is now separated and sharing custody of their 7-year-old.

Foster Parenting and Public Adoption

Private-agency adoptions in the U.S. cost $20,000 to $45,000, while intercountry (or international) adoptions can run even higher, according to data from the U.S. Department of Health and Human Services. But adopting through the foster care system is, in some places, mostly cost free.

Heron, a lawyer and senior policy analyst at an LGBT think tank, is a bisexual woman partnered with a cisgender man. They live in the "incredibly expensive" Boston area. They first "tried for a womb baby," but when that didn't work, "it made sense to think about adopting publicly" because they couldn't afford to go private.

"A year since our kiddo joined our family, we've been able to buy a house with our long-term savings, but only because we did not have adoption fees," Heron said.

Children who have been in state care often get health insurance, a monthly stipend, and -- in some states -- free tuition at state colleges and universities. Heron explained, "These incredible benefits have truly allowed us to focus our energy and money on making sure kiddo can grow up as healthy and safe as possible."

Gay dads Loch and Phillip, who now live in Tennessee but foster-adopted their children in California, chose to foster-parent because Loch had been in foster care himself and Phillip was raised by a missionary on a hospital ship, where he "witnessed great need."

The couple said going public had unanticipated costs associated with it. "The major cost was time," noted Loch. "With weeks of training, county and state inspections, interviews, and more." After a placement, "You have social worker visits, visits with the bio parents -- one or both -- separate therapy visits -- emotional, physical, occupational, educational -- numerous doctors' appointments, and court appearances." Additionally, as a foster parent, "you don't have as much flexibility with schedule" and can't make decisions for the child that a full legal guardian could.

Regardless, Loch calls foster parenting "the best decision we ever made because we now have a beautiful 6-year-old son and 4-year-old daughter."

The family recently moved to Tennessee largely so their biracial children could be near "their own racially diverse, extended family." And yet their kids are among the few children of color at their schools. "The kids have come home with more questions about skin color and why they look different from us," Loch said.

Concerns about race raised financial issues, too. Their daughter's preschool "has a lot of racial diversity amongst the staff" and a good curriculum, so even though it is "a little more expensive than the average" and "required us to look at our budget," they feel it's worth it.

With their son, they assumed he would attend a new school being built near them, but the building was delayed, and it looked like he'd have to move to an unwelcoming school. Homeschooling or private school weren't options because they "would've put an undue strain on us economically." Luckily, the couple got approval for their son to stay in his current school until the new one is ready. "But being a same-gender household nearly led us to having to restructure our whole financial existence so that our son could go to an open-minded school," Loch acknowledged.

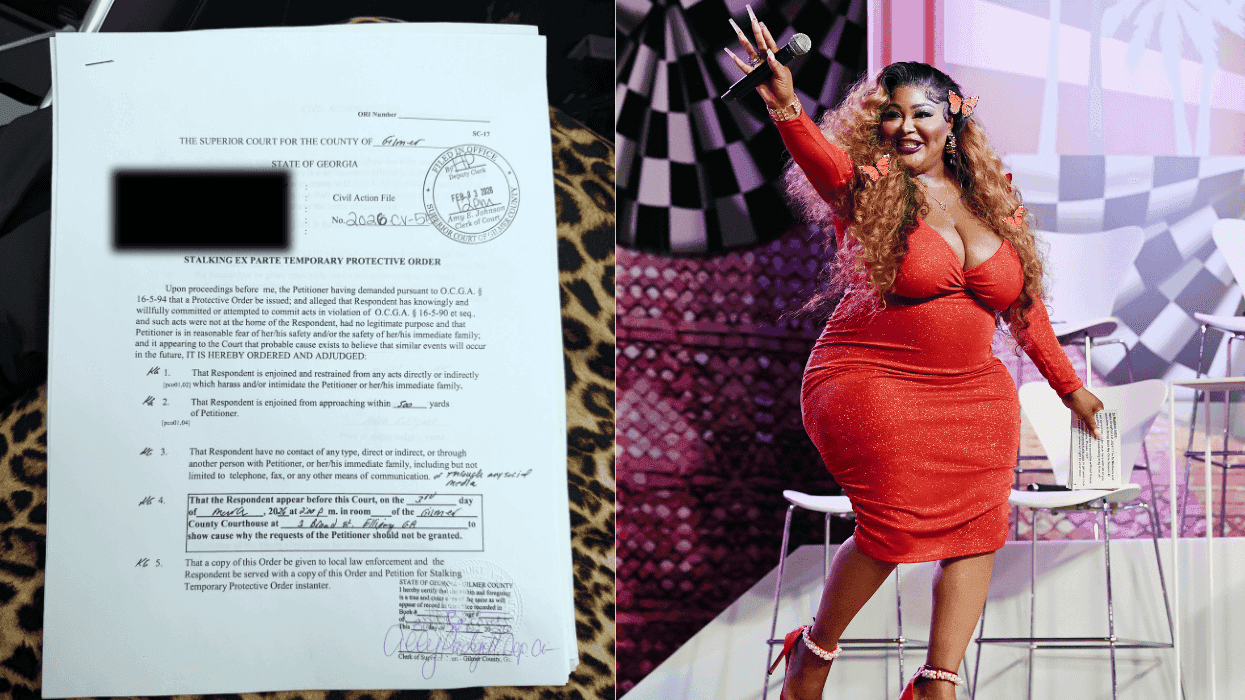

Divorce and Transphobia

Not all the financial difficulties LGBT parents face come from forming a family: some come from the dissolution of one. Meghan, a transgender woman, went through two divorces that have left her financially challenged. An executive at a software company, she said she is now "living month to month." She had a child with her first wife, but when she transitioned -- in a conservative area of Texas -- she lost her family. The costly divorce took seven years to finalize. Meghan provided alimony and child support until their child was 18, and covered college rooming fees.

She and her second spouse had a daughter together via a known donor. The two women separated two years ago, and they are currently going through divorce. They share custody. Meghan is paying approximately $1,500 per month in child support and trying to enact a second-parent adoption, which they hadn't done earlier. "Don't put off until tomorrow what you can get legally protected today," she advised. "Plan for the down times and the changes."

For the second-parent adoption Meghan is paying about $10,000 in legal fees and $1,500 for the home study and background check required in Texas.The cost isn't just financial, Meghan said, pointing to the stress and invasiveness of the process and the probing questions about her own childhood and being trans.

She worries about the potential for trans discrimination -- in court and her life. "That's one of the hard parts about being trans," she admits.

Still, Meghan is committed to providing for her daughter and to making things work with her current partner, who has a 5-year-old son. "Whatever we do, it's about the kids. It's our sole purpose," she said.

Before Beginning

The costs of building a family can begin long before it comes together. A transgender bisexual woman, Hannah is not yet a parent, but decided to bank her sperm before going on estrogen, "to protect my reproductive options in the future." In contrast to those who get paid to donate sperm, the freelance writer, educator, advocate, and comedian who lives in New York has to pay for the costs of banking it herself. "Insurance covered absolutely none of this," she said.

A certified emergency medical technician (although not employed as one), Hannah was able to find a cryobank that offered half-price discount to "first responders." Opening the account and getting initial medical testing still cost about $2,000 at the discounted rate. She was charged $125 for each new "deposit." She stopped after 13 vials. Storage was $500 per year, with discounts for multiple years -- she was able to get 10 years for just $1,500. "I hope I will find a partner and stability by 2022, otherwise I will need to re-up my storage," Hannah noted.

In order to cut up-front costs, she opted out of certain additional testing, but said, "I may have to do some expensive screening of the sperm upon thawing, to even be able to use it."

There's also no guarantee of success. She's been told that "any given vial has about a 25 percent chance of taking" using ICI. As Nicole and Bethany learned, IVF has a higher success rate, but that comes at a price. "I have no idea when I will have a partner and that kind of money," Hannah said. Nevertheless, "I am a lucky one who had some limited means, and was creative enough to shop around for this discount."

But, she reflected, "I am not even sure if I will ever be able to afford to actually use [my own sperm]. [But] I am in way better shape than so many other trans people I know."

Finding a Way

These stories of fiscal challenges and difficult trade-offs are fairly representative of most LGBT families. Single LGBT adults raising children are three times more likely to have incomes near the poverty line compared to non-LGBT ones. Married or partnered couples are twice as likely compared to their straight counterparts, according to UCLA's Williams Institute. Even those with more assets than the average person may find the costs of starting and raising a family very difficult to manage. The parents here are making it work, but it can be challenging.

"I've cut back on a lot," Meghan said. She drives a used truck with 300,000 miles on it.

While trying to start their family, Katrina noted, "We were so broke, with little support. Tiffany worked countless hours, we hardly went shopping." She sees an upside to their frugality. "I think this made our relationship even stronger because we focused on our love and togetherness."

Despite the challenges, Nicole advised other LGBT prospective parents, "Keep searching for options that you can make happen. It is more possible than you think."

Chris and Chelsea added, "The highs will be high and the lows will be low, but when you look into the eyes of your child for the first time it makes it all worth it!"

DANA RUDOLPH is the founder and publisher of Mombian.com, a GLAAD Media Award-winning blog and resource directory for LGBT parents.

Editor's note: Last names withheld for privacy . *Not his real name.