It's no longer enough for many gay consumers that the businesses they work for (or buy from) have a perfect record in their support of gay employees and customers. Target Corp., for example, has a rating of 100 in the most recent Human Rights Campaign Corporate Equality Index, an annual report evaluating how some of the nation's largest companies treat their LGBT employees. But when news broke this summer that the company had donated $150,000 to a political action committee that supported an antigay Minnesota gubernatorial candidate, Target faced Facebook-organized boycotts and protests nationwide.

News of that Target donation is not only forcing gay activists, like those at HRC, to rethink how they evaluate a company's gay-friendliness, it's coming at the same time some other corporations are rethinking what it really means to be pro-gay. A growing number of these companies are coming to the same conclusion as gay people themselves: It's not enough just to make the grade. So these equality-minded corporations are coming up with new envelope-pushing strategies to support their gay employees and, in turn, make themselves more attractive to gay consumers.

One of the emerging tactics is simple: equal pay for equal work. It's not exactly a revolutionary concept, yet it is not a reality, even today. Women's and minority rights advocacy groups have fought against income disparity for decades. But look past the biggest LGBT news headlines of the year and you'll find that equal pay is becoming a mantra for many gay workers and their employers. Progressive entities from Google to the Gates Foundation aren't waiting for Congress to remedy the antigay discrimination that may be costing you thousands of dollars a year.

The problem stems from Internal Revenue Service regulations that have long exempted married heterosexual employees from paying federal tax on health care benefits for their spouses and dependents. But because the federal government doesn't recognize same-sex relationships, gay employees are taxed on what's called "fair market value" of any coverage extended to their partners or spouses. In other words, even if you work for a gay-friendly Fortune 500 company with a 100 rating on the HRC Corporate Equality Index, Uncle Sam is going to take a bigger bite out of your paycheck than your straight coworker's. And the hit is not insignificant. According to a 2007 report by the Williams Institute, a sexual orientation law and policy research center at the University of California, Los Angeles, gay workers who cover their partners' health benefits pay an average of $1,069 more in income and payroll taxes than employees with opposite-sex spouses. Even same-sex couples living in states such as Wisconsin and Maine, which have some form of legal recognition for committed gay relationships, are liable for additional state taxes. Generally, states with marriage equality exempt married gay couples from additional tax, though some, such as Vermont, have yet to update their tax codes to reflect state law.

A bill to end the unfair federal tax for gay couples was passed by the House earlier this year but failed to make it into the health care reform measure passed by Congress in March (the bill is still being considered, although its fate is anything but clear). Outcry after Capitol Hill tossed aside the tax inequity issue failed to gain much traction among gay activists and watchdog groups in the face of other hot-button gay issues this year, namely the fight over repeal of the "don't ask, don't tell" policy and the challenge to California's Proposition 8. "Tax issues are a topic that defies easy explanation and rationale," explains Bob Witeck, an LGBT marketing consultant and partner in Witeck-Combs Communications.

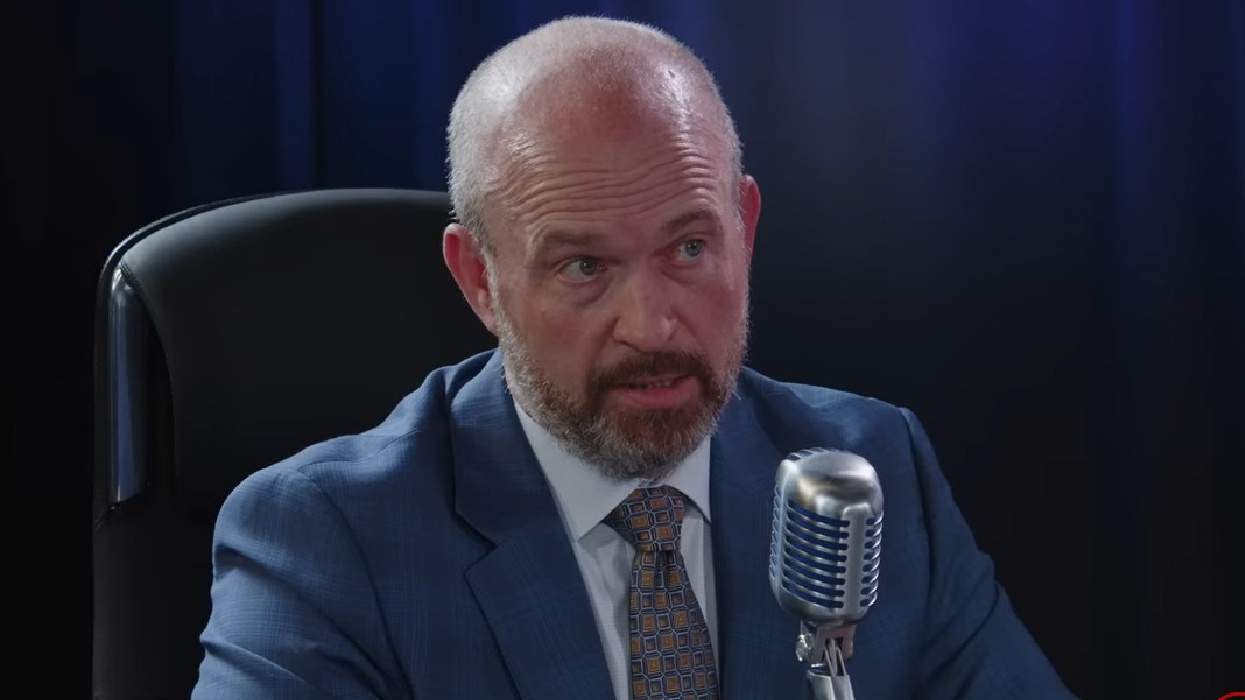

"The climate is changing very quickly," says Todd A. Solomon, author of Domestic Partner Benefits: An Employer's Guide and a partner in employee benefits at the law firm McDermott Will and Emery in Chicago. "With the Prop. 8 [court] decision, who knows what this will do to the national--and corporate--consciousness."

Solomon regularly consults with major companies about domestic-partner benefits and says he's fielded more calls about the "gross-up" option in the past month than in the past two years ("Google was the icing on the cake," he says). Among those currently asking his advice are also companies beyond Silicon Valley--in particular, professional services employers, often located in more liberal U.S. cities (Solomon declined to name of any of the companies).

Prior to this year, Solomon says, most companies seeking equality in benefits for gay employees put their energy into lobbying Congress for a change in the tax code. They did so through a group known as the Business Coalition for Benefits Tax Equity, whose more than 70 members include Bank of America, Deloitte, and Levi Strauss. Current tax code, the group argues, is burdensome not only to gay workers with partner benefits but also to the companies themselves, which have to pay additional payroll taxes and invest in separate record keeping for married couples and same-sex partners.

The Tax Equity for Health Plan Beneficiaries Act, proposed most recently in 2009 in the Senate by New York's Charles Schumer and in the House by Washington State's Jim McDermott and Florida's Ileana Ros-Lehtinen, would end the added tax burden for many domestic partners, though the language of the bill doesn't include any specific reference to gay couples. The choice of language is significant, given that the 1996 Defense of Marriage Act explicitly prohibits the federal government from recognizing same-sex unions. Instead, the term "eligible beneficiary" is used.

The bill's chances remain uncertain after it was scuttled from health care reform, among other controversial provisions. So with a change to the federal tax code an unsure prospect, Solomon says many companies are asking some fundamental questions, primarily, Why is it our job to do anything about the problem? Would it be good for my company?

"If you're trying to provide equal pay for equal work pending a government fix--which everyone knows is not going to be easy and has been proposed several times--you're not going to get there without [grossing up]," Solomon says. As for its advantageousness, he says, "It depends. It can be a competitive advantage if you're in a large industry that depends on recruitment and retention. And Google, after all, has gotten a lot of good press."

One employee resource group leader at a Fortune 500 company used the Google headline to push for change within his corporate ranks. "I don't work for a tech company, but when our group approached executives in June, they were immediately interested," says the group leader, who asked not to be named because he is not authorized to speak to the media on behalf of his company. "We haven't yet seen a change in policy, though I do expect one to happen."

Other gay employee resource groups are more circumspect. "I asked around a bit and the gross-up doesn't seem to be on the to-do list right now," says a group leader at a large professional services firm, who also asked not to be identified. "My guess is that there would be encouragement to add a gross-up if that became a criterion on the HRC [Corporate Equality Index]."

Moulton of HRC says that isn't among new measures in the next iteration of the index, which in 2012 will include revised standards regarding transgender health benefits and equal benefits for same-sex spouses. But barring a legislative remedy, Moulton says gross-ups could be considered for the index in the future.

And yet some companies never waited for the practice to become en vogue. Kimpton Hotels, which operates 50 hotels and 54 restaurants in the United States, began offering gross-ups in 2007. The company has a "large LGBT employee base," says Leslie Lerude, Kimpton vice president of people and culture (otherwise known as human relations).

"We didn't seek press for it at the time--it just felt natural for us to do," she says. "Ultimately we love our LGBT employees, and [the practice] speaks to our culture."

Witeck says the ultimate fix lies in ending a "hodgepodge of relationship laws" in the United States that ultimately lead to unfair tax and benefits treatment.

"I imagine and expect a tipping point will occur in corporate America that would love nothing more than to have uniformity of employee treatment and taxation," he says. "The more complex and costly it becomes, and the more companies look for 'fixes,' it's clear the best and most permanent fix for all coupled relations is marriage equality. When will that tipping point arrive? Not sure, but to me it seems inevitable."

Kimpton Hotels & Restaurants is one of a handful of U.S. companies to pay gay employees added salary to cover a federal tax on their partner health benefits.

Wells Fargo supports a wide range of LGBT business initiatives, including sponsorship of the National Gay and Lesbian Chamber of Commerce's LGBT Business Owner of the Year award.

72% of CEI-rated companies have protections against discrimination based on gender identity or expression, one of the index's most notable successes.

Toyota is the top auto brand for gays and lesbians, according to a national survey conducted last year; the company also has maintained top ratings on the CEI.

Eleven of the top 20 companies on the Fortune 1000 list earned CEI ratings of 100. They are General Motors, Chevron, Ford Motor, Citigroup, Bank of America, AT&T, J.P. Morgan Chase, Hewlett-Packard, IBM, Cardinal Health, and Goldman Sachs.

9.3 million The number of employees represented in the 305 companies that rated a top score of 100.