CONTACTAbout UsCAREER OPPORTUNITIESADVERTISE WITH USPRIVACY POLICYPRIVACY PREFERENCESTERMS OF USELEGAL NOTICE

© 2025 Equal Entertainment LLC.

All Rights reserved

All Rights reserved

By continuing to use our site, you agree to our Privacy Policy and Terms of Use.

We need your help

Your support makes The Advocate's original LGBTQ+ reporting possible. Become a member today to help us continue this work.

Your support makes The Advocate's original LGBTQ+ reporting possible. Become a member today to help us continue this work.

As if tax season weren't stressful enough, gay newlyweds in Massachusetts this year are pondering a new thorny question: Do they check "married" or "single" on federal tax forms? A landmark court ruling made Massachusetts the first state to sanction same-sex weddings nearly a year ago, but gays and lesbians will have to untie the knot this April--on paper at least--since the federal government doesn't recognize their unions. But some aren't ready to declare themselves "single" to the Internal Revenue Service. "I fully intend to file a married joint return, regardless of the fact we're not supposed to," said Arthur Henneberger, 46, of Springfield. "If they kick it back, fine, we'll go to court." While Henneberger might expect to get the full backing of gay rights groups, Gay and Lesbian Advocates and Defenders is one that isn't looking to pick a fight with the IRS. "It's not something that should be done quickly or precipitously," GLAD spokeswoman Carisa Cunningham said. "We wouldn't advise anyone to try to do it alone." Instead, the group is advising the state's estimated 4,900 same-sex couples who married in the past year to file federal returns as if they are single but to note--either through an attached letter or on the return itself--that they were married in Massachusetts. Same-sex couples who are residents of Massachusetts can file joint state returns. The IRS won't say how aggressively it will examine tax returns to spot those filed by same-sex couples. But agency spokesman William Cressman said if these couples are caught filing as married, "the status would be changed and they would be notified of that." The IRS would bill the filer for any overdue amount, plus interest, and possibly levy a fine. Cressman said, however, if people pay up with interest, they probably wouldn't get fined. Filers are permitted to write comments on their returns, but those comments are ignored when it comes time to calculate tax payments or refunds, Cressman said. Electronic filers don't have that option. The issue has cropped up this year because seven gay and lesbian couples who had been denied marriage licenses across the state sued, leading to the landmark ruling by the state supreme judicial court that legalized same-sex marriage. The weddings began taking place May 17. Julie and Hilary Goodridge, the lead plaintiffs in the lawsuit, plan to follow GLAD's advice and file separate single returns to the IRS, along with a letter noting their marriage. "I don't want to do something that's not legal, frankly, whether it's discriminatory or not," Julie Goodridge said. "I consider it every single day, but I won't do it. "We created a lot of change in this state," she said. "There's a lot of ways that we're incredibly lucky. We were able to get married in our home state. If I have to wait two or three or four more years to file a joint federal tax return, then I'm willing to wait." Ultimately, gay and lesbian advocates who pushed to get same-sex marriage legalized in Massachusetts hope to overturn the federal Defense of Marriage Act, which defines marriage as a union between a man and a woman. The issue has troubled Bob Murch and his husband, Gary Halteman. "It's hard enough to be different," Murch said. "I don't understand why the government needs to see me as gay. I pay my taxes, I go to work, I'm a good person." Murch and Halteman's tax preparer advised them to file "single" federal returns along with a certified letter and copy of their marriage certificate. But the couple, who live in Salem, haven't decided what they'll do. "If you say you're single, you've actually lied on your taxes," said Murch, 30. But Murch, who like his husband works for a financial investment firm in Boston, said he won't be offended if he has to file as single. "In any civil rights struggle there's always bumps in the road," he said. "It's just part of what we need to change."(AP)

From our Sponsors

Most Popular

Bizarre Epstein files reference to Trump, Putin, and oral sex with ‘Bubba’ draws scrutiny in Congress

November 14 2025 4:08 PM

True

Jeffrey Epstein’s brother says the ‘Bubba’ mentioned in Trump oral sex email is not Bill Clinton

November 16 2025 9:15 AM

True

Watch Now: Pride Today

Latest Stories

Joe Biden says MAGA Republicans want to make LGBTQ+ people ‘into something scary’

December 05 2025 8:20 PM

'Finding Prince Charming's Chad Spodick dies at 42

December 05 2025 3:45 PM

Supreme Court to hear case on Trump order limiting birthright citizenship

December 05 2025 3:01 PM

Women gamers boycott global esports tournament over trans ban

December 05 2025 2:55 PM

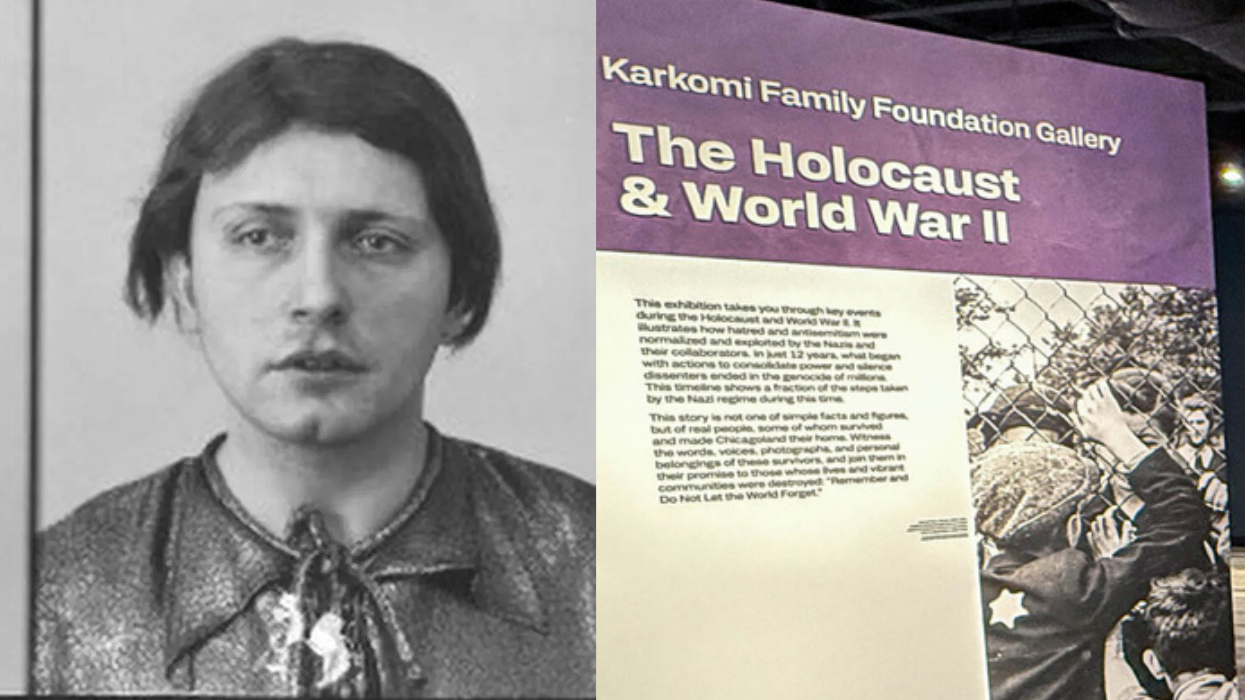

Anti-LGBTQ+ hate crimes reached record-highs last year in this gay haven

December 05 2025 1:16 PM

Three lesbian attorneys general beating back Trumpism in court warn of marriage equality’s peril

December 05 2025 12:07 PM

Trump DOJ rolls back policies protecting LGBTQ+ inmates from sexual violence

December 05 2025 11:12 AM

Georgia law banning gender-affirming care for trans inmates struck down

December 05 2025 9:40 AM

Trending stories

Recommended Stories for You

Charlie Kirk DID say stoning gay people was the 'perfect law' — and these other heinous quotes